TRADING PSYCHOLOGY – PART 1

If you have been trading for any amount of time at all, it is certain you have at least heard of the term Trading Psychology. Even more, you have likely heard of its importance. We at BlackBoxStocks are in full agreement that this psychological element is one of the toughest aspects of stock and options trading, regardless if it is swing, intraday, or long-term. In fact, many trade psych experts agree, that it might be the toughest aspect of trading as a retail trader with your own money on the line…in the biggest market in the world…every time you push the button. Let’s get into it.

WHAT IS TRADING PSYCHOLOGY?

Psychology is the study of the human mind and behavior, according to the American Psychological Association (ASA). It is multi-faceted, and there are many subdisciplines within the field. Trading Psychology (also known as “trade psychology,” “trade psych,” and “trading psych”) is the same concept applied to the emotional and psychological stress that accompanies trading. The past has had no shortage of an unwillingness to accept psychology and its effect on human behavior, often labeled as a pejorative. But those days are past, and psychology and its effect on human behavior and society are recognized. Psychology is recognized as a mainstream area of science, and the increasing openness of its discussion has greatly benefited society.

Trading Psychology is a term that refers to traders’ mental states and the effect of their emotions and emotional reactions that can influence success or failure in PnL. It is widely accepted that trading psychology is equally as important as other factors such as skill and experience when it comes to trading successfully. In fact, it can be argued that learning charting, support and resistance, drawing trendlines, and other forms of technical analysis is pretty easy, relatively speaking. Trading seems mechanical and matter-0f-fact. It seems as simple as 1) identify a strong area of resistance on a chart of a ticker of which you are long-biased, 2) draw a simple trendline of support, 3) if price action rejects that resistance and breaches your support you simply 4) push the button.

It seems that simple.

But often it truly isn’t; it often isn’t simple at all. We are not mechanical by nature; we are complex rational thinking beings…and we have a complex and mesmerizing psychology, and that is often the flaw in the plan.

HUMANS ARE EMOTIONAL

Some traders will attempt to trade robotically, or void of emotion. After using technical analysis on a chart, they will draw take profit or stop loss levels and claim to be able to unwaveringly “push the button” when the profit level has been reached or the trade is invalidated. The notion is that the more mechanical a trader can be, the more successful he or she will be.

And of course, that is true. But there is much more to it, even though it seems simple. The rest of the equation is trading psychology and its itinerant emotions.

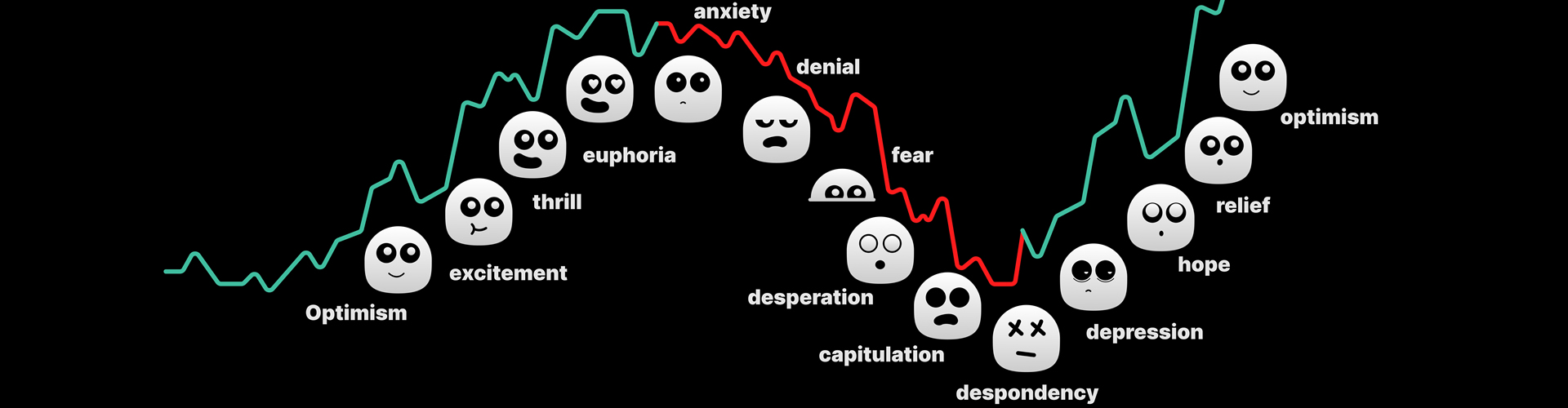

FEAR, GREED, HOPE, REGRET

Fear is recognized as an evolutionary imperative. This just means that as creatures evolve, their species have learned to recognize and pay attention to fear. It is a useful emotion that our species has learned…over many millennia…to obey and respect. Fear tells us if we are too close to the cliff’s edge. Fear tells us if a predator may be hunting us. Individuals who learn to heed fear typically survive longer to pass that behavior down to offspring. And the circle of life continues.

Fear and Greed are often associated with trade psych. Traders are more likely to take profits too soon due to fear. They may fear the trade reversing and losing the unrealized gains that display in their PNL. They may fear they are not good enough and their profit so far must be a simple windfall. If they are not financially secure, they may fear losing enough money to really matter in their day-to-day life. Fear is one of the prime movers of the human psyche, and trade psychology is no exception.

Of the emotions discussed today, fear deserves a special focus due to its categorization of being an evolutionary fear. It is rooted in the mechanism of the brain that is considered ancient, and it has been a feature of humans, very likely, since the beginning. So don’t downplay it and attempt to trade robotically as if you can control fear.

You can come to recognize fear as it enters your trading day and take steps to control its effect on your trading. But no human trader is a robot, and anyone who claims to be that way probably isn’t being entirely truthful. In times of heavy market uncertainty, fear should be at the forefront of your mind. What are you fearing? How is fear affecting your trading today? What can you do to control it? All of these take time, but the effect of fear can be mitigated if not completely eliminated.

Greed also heavily affects profits. A trader may be up 20% on a trade, which was his take profit level, and he may stay in the trade too long and watch a portion of unrealized gains, or all of them, vanish. Greed creeps in during winning trades and convinces the trader he or she should hold longer…just imagine the gains! Often, greed leads to losses.

Worse, the emotion of hope can come into play at that moment and the trader will let the trade go red and be seemingly unable to simply “push the button” that will end the trade and the pain. Hope keeps the undisciplined trader in losing trades far longer than they should be. In the trading world, hope all too often leads to hopelessness.

That often leads to another leading emotion…regret. Regret begets revenge trading and more on this below. Greed, fear, hope, and regret are four of the most damaging elements to trading, and they are all rooted in our psychology.

The problem with attempting to rid oneself of emotions as a trader is that it is impossible. Humans are emotional; it is at the core of human neurology. One can develop trade discipline, of course, but there is no way to rid yourself of emotion. So if you can’t be free of greed, fear, hope, and regret…what can you do? You can study them, understand how you react to them, and acknowledge them. If these things are done, you have a better chance of controlling these emotions when they come up in the heat of an active trade. Humans are emotional, and humans tend to get very emotional when it comes to money. Trading revolves squarely around money. If you don’t do this work, these emotions will control you. And…frankly…you will lose money.

KNOW THYSELF

So then what do we do? How do we acknowledge and start understanding our trading psychology? First, realize that your psychological make up, traits, and emotional profile will show up in your trading. If you are generally a patient, analytical, disciplined person who can control your emotions in times of stress, these attributes will be present in your trading. And, if you are those things, that is great! The odds are more so in your favor.

This is an important point. It is imperative that a trader knows themselves and is honest regarding self-assessment. If you are an impatient person, you will begin as an inpatient trader and you will have to work on cultivating patience. If you are a very emotional person prone to outbursts or even violence, this will wreak havoc with your trading endeavors. It isn’t that you can’t trade successfully if you are hot-tempered; it is simply that it will make it harder for you than for a more even keel person. People who are overly self-confident tend to be the same as traders, and the same is true of people who constantly doubt themselves and are generally fearful. None of these attributes are discussed here as negative…these are simply traits that may influence how you deal with the influence of fear, greed, hope, and regret.

MORE ON THE BIG FOUR

Fear and greed were discussed above, but let’s look more closely at hope and regret. There is a trading slang term you may have heard: “hopium.” It is a portmanteau of “hope” and the addictive drug “opium.” As discussed above, often a trade will go the wrong way and will approach the pre-defined stop area. For this example, let’s assume it is dynamic support in the form of the 21 period exponential moving average. The thesis may have been “if the trade goes the other way and breaches the 21, I am out for a manageable loss immediately.” Alas, price action approaches the 21, and the trader can experience fear. And if the 21 is breached, the disciplined trader will cut the trade, take the loss, and move on. However, often the price action will dip just below the exit trigger and consolidate for a moment. Too often traders will hang on for “just another candle or two.” Perhaps the trade reverses, and the trader may even profit. This isn’t good trading; that is simply luck. Too often, the trade will blow past the 21 and the trader…unwilling to “push the button” will shift to new support…perhaps VWAP is just below. And then if that is breached they can, unfortunately, end up far enough down on a trade that they feel they might as well let it ride and see what happens. At that point, there is nothing left in the trade except hope that it reverses. The trade is at the mercy and whim of the market. This is not an informed manner of trading, and it is so common it has been referred to as “hopium.” Not obeying stops and devolving into nothing save hope is a way to blow up your account.

And when “hopium” does not pay off, the last of the Big Four comes into play…regret. This emotion is powerful on many levels in all aspects of our lives, as well as in trading. One scenario that often plays out with regret is that it follows a losing trade or a series of losing trades. The trader fixates on the money lost in the trade or trades and ends up getting into new trades too hastily in an emotional attempt to make the losses back. Unfortunately, this leads to hastily forced trades that result in additional lost capital. This can lead to “revenge trading” where a trader enters less-than-data-informed trades in order to recoup trading losses. Regret can also play a part if a trader takes profit too soon and feels as if they have “left money on the table.” That regret can lead to greed in the next trade, and greed often leads to losses…which leads to regret…which leads to…the point that is clear! Fear, Greed, Hope, and Regret are significant psychological issues in trading.

If you are new to trading, it is crucial to start thinking about this issue. No one is immune from trading psychology and one’s personal, unique, psychological makeup. Your psychology will affect how you trade; a trader can try to ignore this fact, but the effect will be evident whether it is recognized by the trader or not.

Keep in mind that this is a general overview, and the next installment will feature a more detailed examination of how emotion and psychological subjects can affect your trading. Between finishing this article and reading the next, take some time to reflect on how you react to greed, fear, hope, and regret in your trading journey, and your non-trading life as well. It is surprising how many mistakes…both in life and trading…can be tied to these emotions.