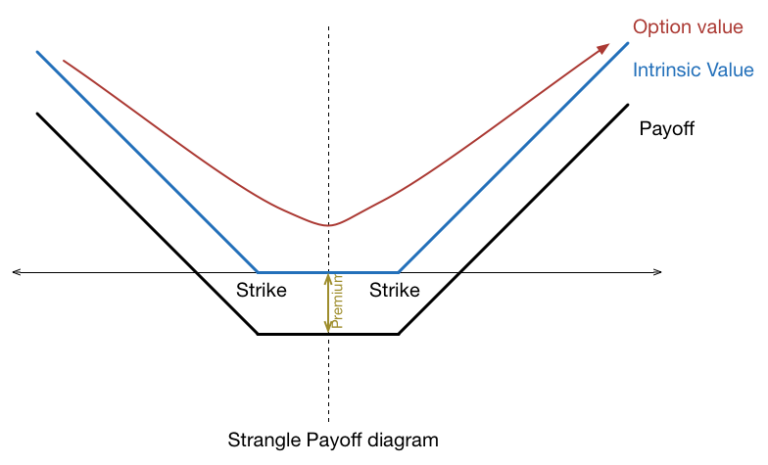

A deep look into the factors that create options pricing. An option’s premium has two main components: intrinsic value and time value.

During this free presentation from OICSM, attendees will learn about:

- Intrinsic Value (calls/puts)

- Time Value

- Major factors influencing options premium