Today, we shed light on a frequently misunderstood segment of the market – Dark Pools. Our aim is to help traders harness the power of this data in building data-informed trading strategies. Full-time moderator, Mel Stone, provides a comprehensive course to our members, equipping them with insights into the nuances of dark pool data integrated with our indicators and charts. In this article, we’ll delve into the basics of dark pools, indicators, alerts, and strategic use of this data in conjunction with options flow for informed trading.

Dark Pool Trading – Unveiling The Basics

Tracing dark pool trading transactions paves the way to trail the big money. These transactions, often referred to as “prints,” depict how large institutions invest their capital. Large market participants turn to this type of trading to achieve bigger fills and better prices by conducting transactions on private exchanges, predominantly operated by investment banks.

Understanding Dark Pools So, why are they called “dark”? It’s because there’s no open order book, and they’re inaccessible to the general trading public, who engage in the more familiar “lit” exchanges like NYSE, NASDAQ, or OTC. While these public exchanges flaunt open order books or Level 2 data, allowing the visibility of big buys and sells, the same transparency doesn’t apply to private exchanges.

Contrary to popular belief, dark pools aren’t shady or illicit. They operate under the watchful eyes of the SEC, and approximately 40 to 45% of all trading volume takes place outside of the lit exchanges. All trading volume must be recorded as per FINRA regulations. This includes private exchange volume, which is accessible to the public.

Dark Pool Trading Indicators: Spotting the Trends

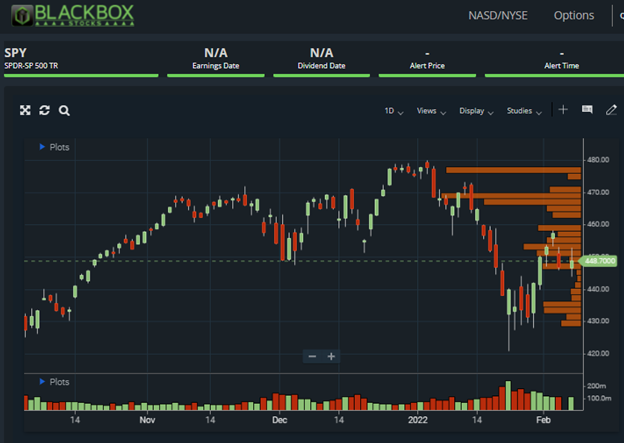

For accurate and up-to-date dark pool data, turn to the BlackBoxStocks system. It offers real-time tracking of trade price and volume levels. Our proprietary dark pool indicator delivers insights in the blink of an eye.

Deciphering the Indicator It’s essential to remember that we can’t ascertain the directional intentions of the trade. Yet, charting these prints can provide valuable insights to stock and options traders.

Dark Pool Strategies: Constructing A Trading Plan

Integrating dark pool prints into your trading plan can establish strong support and resistance. For the strategy to work, you need to understand the relative size of prints for individual tickers. Pairing this data with unusual options activity can potentially open the door to profitable trading opportunities.

Unusual Options Flow and Dark Prints: Piecing the Puzzle Together Unusual options flow can sometimes hint at the directional intentions of the trade. Combining these with the print levels on charts can assist in constructing a well-informed trading thesis. Dark prints and options flow essentially serve as breadcrumbs, leading to potential profit.

Exploring Real Examples of Dark Pool Trading Activity

In a noteworthy example of the kind of dark pool trading activity that traders should watch out for, the semiconductor sector experienced significant dark activity on February 3rd 2022. This was not business as usual — each and every semiconductor stock in the sector exhibited dark pool data, with most of the activity occurring in the last few hours of the trading day.

According to our in-house dark pool expert, this is an exceedingly rare occurrence. In fact, it’s so unusual that it could potentially indicate a significant shift within the sector. Once again, we must stress that there’s no way to ascertain whether these dark pool transactions were buys or sells. Yet, the sheer volume and scope of the activity are remarkable and warrant vigilant monitoring by traders.

Adding more intrigue to this scenario, one of the sector’s major players, Nvidia (NVDA), was set to report its earnings on February 16th. In light of the mysterious flurry of dark pool activity, traders would be wise to keep a close eye on NVDA’s performance and the broader semiconductor sector.

Finally, macro-economic factors and political dynamics can also play a crucial role in shaping the trading landscape. Recently, for instance, the White House expressed a desire to boost the supply of semiconductors. While it’s unclear how this situation will ultimately unfold, these recent developments suggest that the semiconductor space could become a particularly lively area for traders in the near-term.

In summary, while we cannot predict the outcome of these events, being aware of such substantial dark pool activity and its potential implications can give traders a valuable edge.

The Power of Knowledge in Dark Pool Trading

Every aspect of stock and options trading mandates comprehensive education. Dark pool trading, despite its recent popularity, often falls prey to misinterpretations and misunderstandings. As such, it’s crucial to gain accurate information and undertake careful study. Adding dark pool trading knowledge to your toolkit could offer a powerful advantage in tracking institutional money for potential profits.