In the world of options trading, understanding different trading strategies is crucial for success. Two popular strategies are straddles and strangles. Both straddles and strangles allow traders to profit from significant moves in a stock’s price, regardless of the direction. However, each has its unique characteristics. In this post, we’ll delve deeper into a comparison between long and short straddles versus strangles.

The Cost and Break-even Points

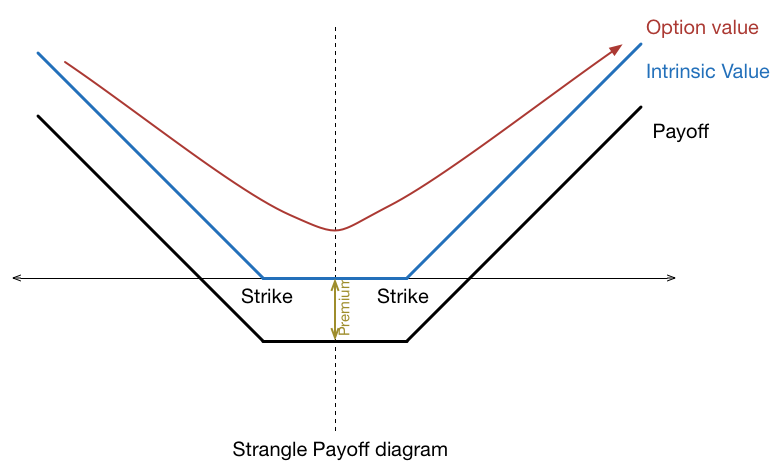

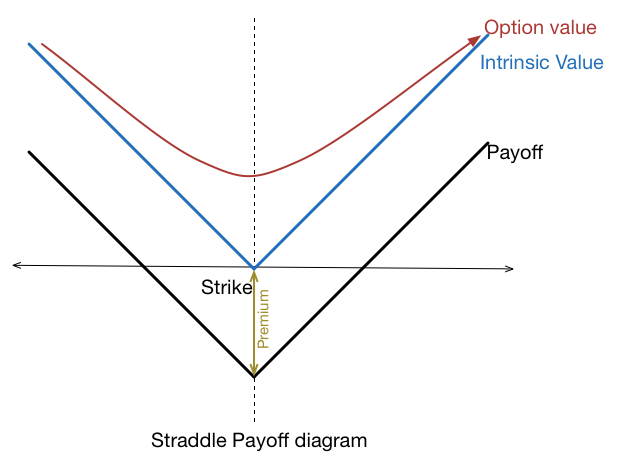

When buying a straddle, which involves purchasing at-the-money options, the cost is generally higher than that of a strangle, which uses out-of-the-money options. This is because at-the-money options carry a higher premium due to the higher probability of making a profit. The break-even points for these strategies will also differ based on the strike price and the premium paid.

Calculating Expected Stock Price Movements

An interesting point to note is the concept of the ‘expected move.’ You may often hear economists or commentators discuss the expected move of a stock price prior to a significant announcement. This is usually calculated using straddles. For instance, if a stock is trading at $100 and the $100 straddle is trading for $5, and you’re using options that expire right after the event, the market expects a 5% move ($5 out of $100 strike price).

Alternative Calculation Methods

An alternative calculation method is often used for options with more available strike prices and smaller widths between these prices. Traders will take the at-the-money straddle and add to it the nearest out-of-the-money strangle (combining the nearest put strike and the nearest call strike). The total is then divided by two, providing a different perspective on the market’s expected stock move.

Why would traders use this calculation? The answer goes back to the idea that implied volatility levels may always be slightly higher than what the market truly anticipates the stock will move. This is because option sellers want to be compensated for the risk they assume in selling options. By combining the straddle and strangle and then halving the result, the expected move is somewhat reduced, potentially compensating for the slightly inflated implied volatility.

The straddle calculation is more straightforward, using just one strategy. But the hybrid method of combining the straddle and strangle may provide a more nuanced view, especially for stocks with numerous strike options or narrow strike intervals.

Context is Key

Ultimately, it’s essential to remember that the choice of computation can depend on the specific circumstances. For lower volume stocks, options may have wide strikes, and the strangle may create too significant a difference. However, for stocks with half strike or dollar strike intervals, especially higher-priced stocks, the hybrid computation could be more relevant.

The strategies of long and short straddles, as well as strangles, can be potent tools in a trader’s arsenal. Understanding their nuances, the ways to calculate expected moves, and when to apply each can lead to more effective and informed trading decisions. It’s always advisable to consider these tools as part of a larger, comprehensive trading strategy.