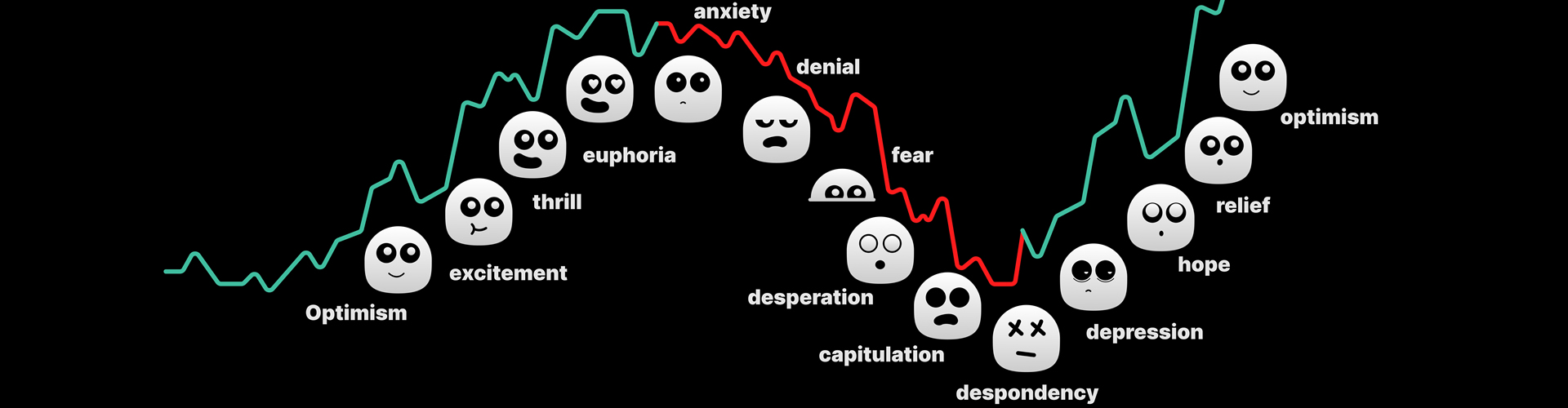

Welcome to part 2 of our examination of Trading Psychology! Part one discusses “the big four”: Fear, Hope, Greed, and Regret and how they can affect your trading. It also discusses the basics of what trading psychology, and psychology, is. If you are brand new to this subject, begin with that article. Also be aware that trading psychology is one of the most widely recognized obstacles standing between traders and success. It is a relatively simple affair to learn how to read charts, interpret market internals and trends, and plot accurate support and resistance on any chart, be it equities, options, crypto, or futures. It seems to be a simple proposition to simply sell when a trade is invalidated or to take profit when a trade is successful. As discussed in the first part of this series on trade psych, however, the big four emotions of fear, hope, greed, and regret immensely complicates the matter. Check out part one, here is a link to Trading Psychology, Part 1

Now that we have covered the basics, what are some deeper canonical silos within trading psychology, how do they affect us, and how can we acknowledge them and keep them under control? That answer will, of course, vary by individual. However, here are three concepts that can be very useful include 1) combating “Fomo,” 2) position sizing to avoid fear, 3) loss aversion, and 4) herd behavior. This will not be a comprehensive overview of these deeply complex psychological trading obstacles; however, it will be helpful for new traders to understand the basics of these four phenomena.

COMBATING FOMO

“FOMO” is an acronym for the notion of “fear of missing out.” This is a common problem in all walks of life, and it is very appropriate in the stocks and options trading world. This phenomena is what one feels when he or she sees others benefitting or enjoying something that they are not experiencing. In trading, often a stock will have a squeeze or a drop and the trader might regret missing out on an entry before the move happened. Imagining all the gains she could have made, the trader can feel motivated to jump into the trade late after the real profits have been made. This often occurs with a complete lack of focus on technical analysis, risk/reward, or any other traditional metric. And, not surprisingly, this results in losses.

The first thing traders can do to combat FOMO is to simply be aware of it. It is a normal experience to feel anxiety about what “might have been” when you see many social media posts / etc. regarding the explosive gains that other traders made. Knowing that FOMO is a real and inherent risk can keep one from entering a trade too late. Understand that the stock market has universes of opportunity, and if a trader is patient she can easily catch the next one and not be caught either buying right at resistance…or even worse, at the dump of a short squeeze or catching a falling knife. FOMO is a psychological reality, and simply being aware of it can help traders combat it…and hopefully keep them from falling victim to it.

POSITION SIZING TO AVOID FEAR

One thing new traders constantly fail to recognize is that every trader is in complete control of how much money he loses. It seems commonsensical, but you can not lose more money in a single leg options trade than the premium you spend. If you are not comfortable potentially losing five thousand dollars, do not buy five thousand dollars worth of options. It is always possible you can lose all your premium, so you can limit your maximum loss by the amount you put at risk in the market.

Fear is one of the most prominent emotions affecting trading psychology. Everyone reacts to fear…it is an evolutionary motivator after all. However, different individuals will have a wide variety of reactions to fear. As money is so closely tied to things such as security and even happiness in our society, issues revolving around losing money can engender a significant amount of fear. One of the biggest fear enablers in the stock market is that of inappropriate position sizing.

Let’s say a trader has a five thousand dollar trading account and is all-cash at the beginning of the day. Seeing what he believes to be a great setup, he might have some impatience and decide to go heavy into the position before confirmation is entirely clear. He has a directional bias, and his (biased) due diligence tells him he is getting in a bit early. No harm in that! In fact, his bias whispers in his ear, it will likely mean even more profits. Alas, he enters into $2,500 worth of options. He is in the position with half of his account (note to all: this should never happen. Don’t do it).

And, of course, the trade meanders and eventually goes against him. If he had two hundred dollars worth of options, it would be much easier to cut the trade. His net losses will be smaller, and his buying power will be much less affected. However, if a trader is over-positioned in a losing trade that goes against him he is much more likely to hold on to it longer resulting in much bigger losses…and psychological damage…than if he would have simply cut according to his rules. Additionally, if the amount of money is such that he cannot afford to lose it, these forces are even stronger. The bottom line is that traders should not be risking money that they can’t afford to lose in the options market. Having a position size that is too large is a sure way to lose more money than you have to. The way to combat this psychological issue is to always use position sizes that you can…if it comes to it and everything blows up…lose completely. This will make you focus on small consistent gains and keeping your losses small.

LOSS AVERSION

Loss aversion is a psychological topic that means traders often are more concerned, and feel more emotions toward losing money than they do making money. The fear and stress of losing money, in other words, is more intense than the joy they feel in making money. If this is the case, traders will place a higher psychological importance to avoid losses than to make gains. This is a very common issue, and it can have devastating effects on one’s trading profit. Sometimes more emotion will be involved in losing fifty dollars than gaining twice that. There is something deeply psychological about admitting you were wrong and pushing the button to close out a losing trade. As all traders know, once the options trader sells to close, that trade is dead and buried. Even if it profited thousands of percent the very second after you close the trade, you have no part of that rally. The trade is over. Selling to close is a finality that people often try to avoid in life. Selling to close at a loss involves an inherent understanding, and admitting, that you were wrong, the trade didn’t work out, and you are losing money as a result. This is deeply emotional, and it is a barrier for many new traders. A way to begin to combat this is to position appropriately. If you have an amount of contracts that you can absorb a total loss on with little to no financial pain, you will be more likely to avoid active loss aversion when your trades go the wrong way. And, as everyone should know, you will incur losses as a trader. The key is to recognize them and to keep them manageable. If you cannot learn to do this, you cannot keep trading. That is a simple economic fact of trading education life.

HERD BEHAVIOR

The last psychological notion examined in this series is the long observed and studied notions of herd behavior. Humans, at the core of our existence, are highly evolved social animals. We tend to form herds with like-minded individuals and thrive best when a member of a respectful and healthy community. That has many psycho-social implications in most areas of our lives; however, it is very relevant to trading…especially in the age of social media. There is a tendency for humans to replicate perceived mass behavior. This “perceived” part of it is pertinent. Often, various trading-focused social media sites will feature discussions of tickers that are trending at any given time. Many of these users are not heavily informed regarding the market on any given day, and sometimes there can be overwhelming directional sentiment in a small group that might not be representative of the actual situation. If one is in a position and the trade isn’t immediately going one’s way, it can be easy to be influenced by this perceived mass behavior. It could make you hold on to a position that the chart suggests you should sell or the inverse. Just because there is a prevailing sentiment regarding the market does not mean the market will reach accordingly. As always, the trader’s job is to observe the market and react to it with data-informed decisions. Recognizing our tendency to fall victim to herd behavior can help us be more aware of it. And awareness of this phenomena, as is the case with all of these issues discussed in this article, can lead to a better ability to both recognize the behavior and to bring it under better control.

TRADING PSYCHOLOGY TAKEAWAY

At the end of the day, traders simply must understand that psychology is likely the biggest challenge of the retail trader. To ignore this topic is to do so at your own detriment and extreme financial peril. Some will claim that it is possible to trade “mechanically” or “robotically.” That is inaccurate. Sure, with experience traders can learn to obey their rules and follow a system; however, if a trader is human he or she will always be subject to psychological forces at work within themselves. There is no escaping this sometimes overlooked aspect of trading. There is only recognizing it, studying it, and improving upon it.

Perhaps the ancient Greek philosopher Socrates’s most famous quote is paraphrased as “know thyself.” That is recommended in all aspects of life, and it is no different in trading. Some traders have trouble making the decisions needed to successfully scalp options. If that’s the case, they should stick to longer term swing trading. Conversely, some traders simply cannot hold a profitable position long enough to swing. Perhaps they would be excellent stock and options scalpers. And there are people who have different approaches and systems based on different days and moods they might be in. The takeaway is to know yourself, and your psychology, as a trader. Don’t force yourself into a type or style of trading that is incompatible with your inner landscape. Try different types of trading with very small and manageable position sizes until it is clear which you prefer. Then, dive deeply into trading psychology so you might understand more about why that type of trading appeals to you and how you might work to become more profitable. Thank you for reading this two-part introduction to trading psychology here at BlackBoxStocks!